Author: James Steven

If our nation can issue a dollar bond, it can issue a dollar bill. The element that makes the bond good makes the bill good - Thomas Edison.

With these words, Thomas Edison joined the ranks of esteemed personality's (such as Andrew Jackson, Aristotle, Benjamin Franklin, King Henry 1st, Julius Caesar and Thomas Jefferson) in the call for the establishment and implementation of debt free money.

Indeed, King Henry 1st, son of William the Conqueror enacted an innovative construct of debt free money in 1100 AD. Moreover, this unique tally stick mechanism was immune to inflation and usury. Additionally, this extraordinary monetary system endured for over 700 years, and is still the most successful form of currency in recorded history.

Ultimately, the desires and actions of usurious villains would gradually undermine and cause this unique monetary system to be discredited and abandoned.

Nonetheless, in the years following the abandonment of King Henry 1st monetary system, the world has transformed from an agricultural to an industrial economy. And as we now transition to a knowledge based, disruptive economy drowning in personal debt, a perfect storm is approaching for the masters of usury.

The Perfect Storm:

1. Disruptive technology.

Structural deflation started with the systematic application of scientific knowledge to emerging technologies, and this disruptive innovation has engendered copious benefits to most people worldwide.

However, disruptive technological change is exponential, and the accelerated returns of these transitions are set to crush current economic, social and government models.

The Internet continues to be the most disruptive innovation of our time, it allows an enormous flow of information and ideas to reach the four corners of the earth, and provides opportunities to educate and participate in humanity's knowledge base.

Moreover, the internet will be the backbone of the converging wave of disruptive technological changes that will bring about these exponential changes.

Another innovation, still in its infancy is the mathematical wonder of the blockchain, this concept has the power, in time to rob the masters of usury of their power to fabricate debt based money. Indeed since their establishment, banks have been a systemic menace to global economic well being.

Their central role in clearing, processing and creating money, has ensured efficient trade and their failure to perform such a role within the current outdated financial framework would trigger devastation on a global scale.

Nonetheless, as experience has shown us, decentralised models are inherently superior and the creation of a tradable, stable and decentralised digital currency delivered into existence, debt free. Would ensure prosperity for the majority and break the back of an outdated and restrictive economic model.

It is no small wonder then, that financial institutions are desperately trying to climb onto the back of the blockchain phenomena in order to control and direct this new disruptive technology. But we can rest assured, if the masters of usury cannot control a one world digital currency based on credit to ensure their survival, they will do all they can to discredit and destroy a decentralised, digital currency delivered into existence, without the burden of debt.

"A quick note to the hacktivist movement. Shutting down the websites of financial institutions for two or three days is like stepping on the tail of a snake, it would be far more beneficial to work quietly in the background with the collective aspiration of securing the future of a debt free, decentralised, digital currency".

Yet, another phenomena enabled by the internet is the peer to peer economy and although this too is in its infancy, there is no doubt that the growing momentum of these disruptive platforms is undeniable.

By 2025, this economy is expected to generate 335 billion in global revenue and will consist of a wide range of industries and sectors, from administration, accommodation, creative production, finance, media, transport, and software.

Although the predicted increase in global revenue attributed to the peer to peer economy is set to grow, the uptake of new technology usually has a deflationary effect and we may yet see a net loss to the overall economy.

Consequently, the deflationary pressures of a peer to peer economy will impact the profitability of established industries and service providers, the production of goods and services, the conditions of workers and the rights of consumers.

Discussion around the regulatory implications, and the needs in relation to the peer to peer economy have just begun within the confines of governments, and a clearer picture of this new technology will emerge in time.

But when the robots come, their deflationary effect and the labour destruction will be difficult to comprehend. In fact, it is the insidious creep of technology we should fear the most, because the robots will come in many sizes, shapes and forms and their effect on society and labour will be devastating.

Resource efficiency and zero downtime will drive technology, company profits, structural mass unemployment and trigger the decline of our capitalist system based on consumption.

Let's consider the emerging gene splicing technique called CRISPR and the devastating affect it will have on the dairy industry as a bulk protein supplier, because in the very near future genetically modified yeast will be programmed to produce disease and parasite free vegan cow's milk.

Moreover, dairy companies will be able use economies of scale and favourable locations that will ensure the devastation of dairy farms and industry jobs world wide. Within fifteen to twenty years dairy farms, even the animals themselves will be economically non-viable as bulk protein suppliers.

On top of this, further automation such as extraction, bottling and delivery to local markets will erode other livelihoods associated with the current dairy industry structure.

Another victim of emerging technology driven by the need for resource efficiency and return on investment will be small to medium acreage horticultural farms, usually owned and operated by families, and in some cases this stewardship is generational.

Their economic demise will come in the form of vertical farms and efficient computer controlled environments located in the heart of all major urban populations.

Consequently, the need to transport seasonal produce around nations and internationally will be eliminated, and the return on investment for companies and shareholders involved in this disruptive model will ensure their success, and the consistent abundance of a seasonal product will ensure deflation.

As a result of these emerging disruptive technologies, current wealth producing assets are under threat of becoming at best worthless and in some cases a burden to their owners.

The demise of wealth producing assets, structural mass unemployment and systematic deflation created by emerging technologies will hamper the consumers ability to prop up our current economic model, and force governments to question the viability of a system based on consumption and growth.

2. Structural mass unemployment.

With the very real prospect of billions of people without gainful employment and the resulting social and economic breakdown of our current system, which favours usurious villains. The think tanks funded by these very same individuals are hell bent on trying to persuade governments to enact policies, which maintain or even increase their wealth margins.

After all, its is not the vast sums they control, but the margin spread between the haves and the have nots that is important. And they have shown in the past, that they are willing to sacrifice the aspirations of the poor and middle class to maintain their privileged life styles.

Governments will be coerced into action, by highly funded think tanks to use increasingly sophisticated technologies to control people, and adopt evermore restrictive legislation in order to justify the stifling of legitimate expressions (e.g. fake news).

Many governments have already enacted legislation for the swift implementation of biometric databases in order to increase efficiency, and reduce costs in their drive to criminalise their own citizens.

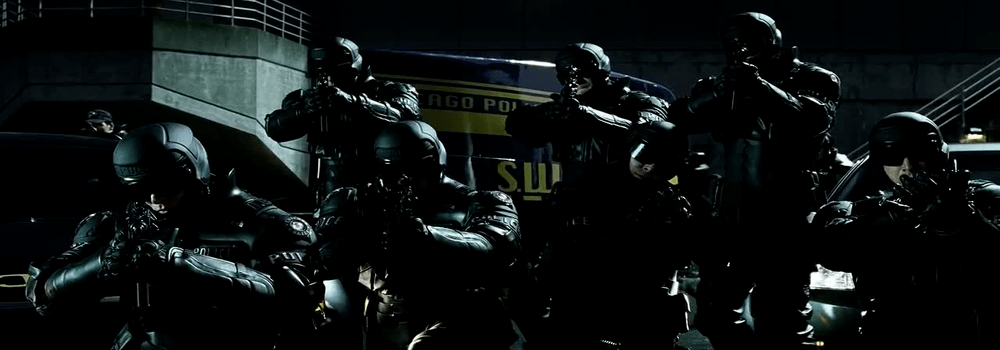

The heavy use of mass surveillance on citizens and the lowering level of criminalisation, as well as the normalising of these oppressive tools, will no doubt need strong paramilitary police forces.

However, the use of oppressive measures to control people throughout the ages has proved fruitless and the use of paramilitary forces, propaganda and manipulative legislation will only extend the power and privilege of usurious villains for so long.

In conclusion:

The last desperate attempts of usurious villains to protect their wealth and privilege, at the cost of all others is drawing to an end. The deflationary pressures of emerging and resource efficient technologies will bring mass unemployment, and force governments to re-think our capitalistic system.

How the middle class retains their hard earned wealth in an abundant, deflationary world or even their need to retain it, when abundance will bring untold privilege is a future we will all need to explore.

This file has been viewed 672 timesCopyright © 2016 - 2024 HardcoreInvestments - Published content is licensed under a Creative Commons License